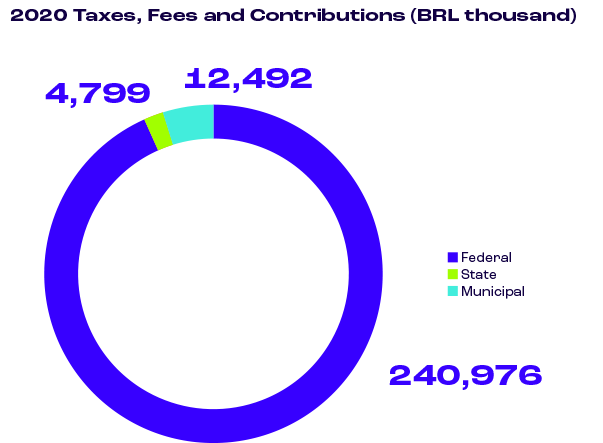

Tax planning

All taxes and contributions levied on BRK’s activities and profit generation are due and paid in Brazil. The company, headquartered in the city of São Paulo and with business units spread across seven states in the country, does not have operations in offshore territories, which have tax advantages in relation to Brazilian legislation.

Annually, in its Business Plan approved by the Board of Directors, BRK estimates future financial performance and future generation of taxable profits. With this, it establishes a provision for probable additional amounts due.

The permanent control and recording of deferred taxes is made through the company’s tax area. The recognition and the amount of taxes depend on the future generation of taxable profits, which requires the use of estimates approved annually by management. The company constantly monitors the accounting balances and performs reconciliations, with audits conducted by an external independent firm, ensuring that the amounts are correct and in accordance with Brazilian legislation.

The company also has a policy for allocating part of the taxes and contributions to investment in socialenvironmental actions, in accordance with the incentive laws approved by the Federal Government, the states and the municipalities.

This planning takes place within the scope of the business units, which allows the allocation of resources in social actions and projects that promote sustainable regional development in a way that is aligned with the interests and expectations of all stakeholders.

Tax benefits

BRK also seeks efficiency and optimization in the tax area. Based on the understanding consolidated in national jurisprudence, the company works to ensure possible and legal optimizations for the payment of taxes and contributions. In some cases, the company resorts to the courts to gain access to these tax benefits. BRK is involved in approximately 140 lawsuits that discuss the payment of taxes and contributions. Of this total, about 85% were still pending in the courts in January 2022.

The management of these lawsuits is carried out by the company with the support of outsourced law firms, using a digital system to centralize information and monitor the processes, updated periodically.

Moreover, teams from the tax and legal areas meet weekly to assess the impacts of legislative changes, higher court decisions and relevant tax theses, often with the presence of partner firms. These meetings allow the company to be always up to date and attentive to the need to file lawsuits to discuss theses that allow for the optimization of the tax budget.

Tax exemptions are relevant mechanisms to benefit society. The tax waiver exercised by the State is reverted for the benefit of local society, enabling the reduction of tariffs charged for the provision of water and sanitation services. Two business units (Jaguaribe and RMR), for example, make use of a tax benefit for the IRPJ for a period of ten years – the rate is reduced by 75%.